How to Finally Get Rid of Your PMI or FHA Mortgage Insurance

If you’re planning to apply for a mortgage to help you finance a home purchase, you could get stuck paying mortgage insurance, depending on the type of home loan you take out and your down payment amount.

If it’s a conventional mortgage you’re applying for, you’ll need to come up with at least 20% towards a down payment, or else you will be required to pay Private Mortgage Insurance (PMI) on top of your mortgage payment. The amount you pay is based on a percentage of the initial purchase price of the home.

Fees for PMI range from anywhere between 0.3% and 1.5%, depending on factors such as your down payment amount and credit score. The higher these numbers are, the lower percentage you’ll likely be charged.

If you’re applying for an FHA-backed home loan, you’ll automatically be billed for FHA Mortgage Insurance Premium (MIP), which is an insurance policy that protects lenders if borrowers default on their mortgages. Regardless of the down payment amount, borrowers with an FHA-backed home loan will be responsible for paying MIP.

Since FHA loans come with less stringent lending requirements for borrowers – including a lower down payment amount and lower credit scores for approval – lenders who are eligible to issue them need added protection in the event of mortgage default.

FHA mortgage insurance policies have two separate payments: one is a lump sum that is paid upfront, and another is paid on a monthly basis over the life of the loan.

Regardless of whether you’re paying PMI or FHA MIP, the added fees can make your mortgage more expensive than it has to be. But there may be ways to get rid of that extra payment for good at some point in the future, which will help you keep more money in your pocket every month.

How to Eliminate PMI

Before you can get rid of PMI, you will need to pay down your mortgage to at least 80% or less of the principal amount of the loan. This can be done in a few different ways, including the following:

Pay down your loan – The most obvious way to get to the 80% equity mark is by simply contributing to your mortgage every month until your loan-to-value ratio (LTV) – which is the loan amount relative to the value of the property – is 80% or less. Once you’ve paid off at least 20% of the original loan amount and reached the 80% LTV threshold, you should be eligible to have PMI eliminated.

That said, you will likely have to get in touch with your lender once you’ve reached that 80% mark, as PMI cancellation doesn’t happen automatically until you’ve actually reached 78% of the outstanding principal.

Have the home appraised – The great thing about real estate is that it typically increases in value over time. Many real estate investors have built wealth by simply owning and holding real estate and allowing appreciation to add value. If you believe that your home is worth a lot more than what you paid for it, you may have built up enough equity through appreciation to bring your equity amount to at least 20% of the home’s value.

In this case, you would need to contact your lender to have an appraiser come out and assess the current value of your home. If it is determined that your home has in fact increased in value to the point that you’ve reached 20% equity or more, PMI can be removed.

Refinance your home loan – Another way to remove PMI from your mortgage is to refinance your mortgage. If you can refinance with a new loan that accounts for less than 80% of the value of your home and has a lower interest rate than your original home loan, you may be able to have your PMI dropped from your mortgage. Having said that, you’ll want to ensure that refinancing makes financial sense for you.

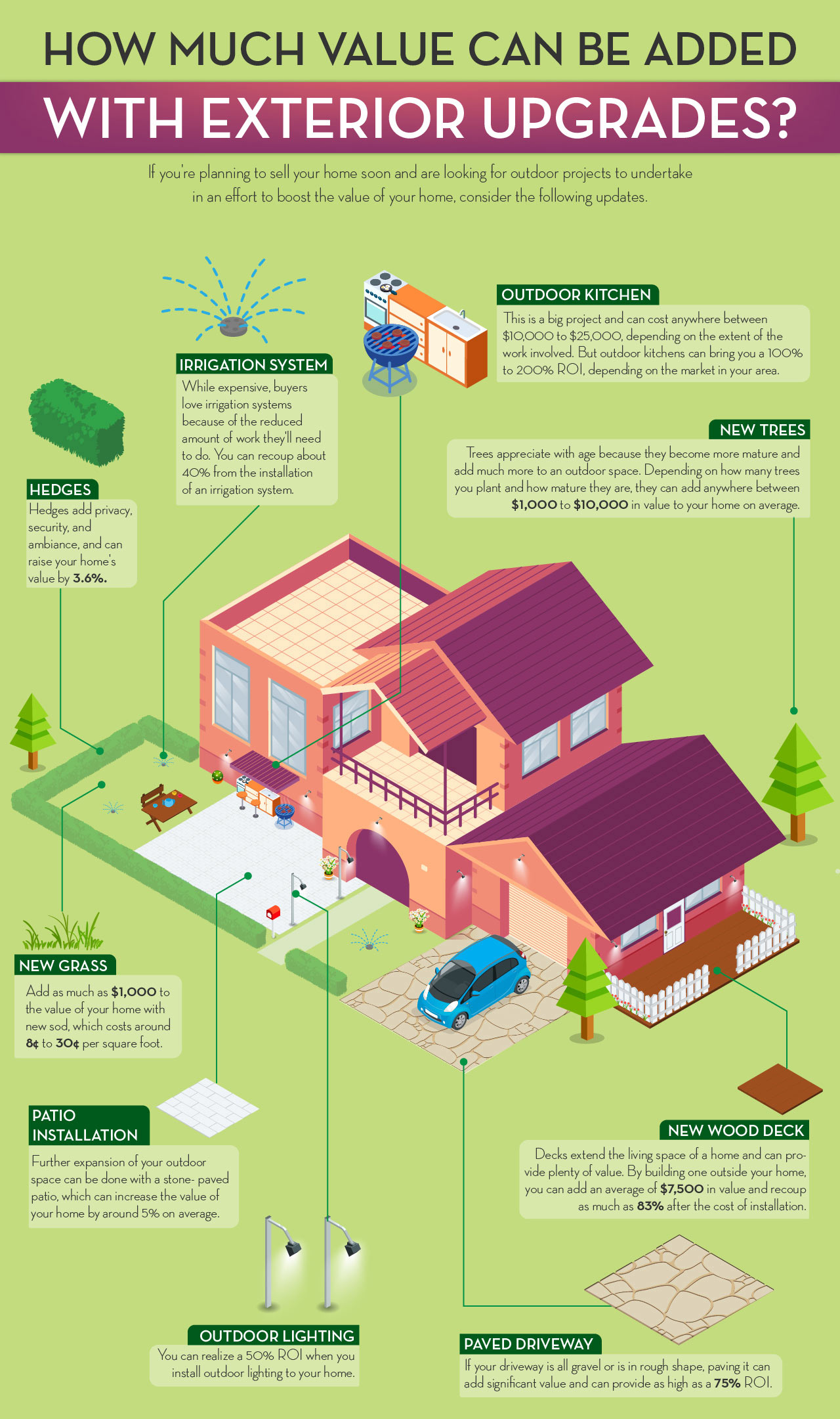

Update your property – By taking on certain home improvement projects, you may be able to effectively add equity to your home to make you eligible to have PMI removed. Just be sure to tackle smart projects that will add more value compared to the cost of the improvement. Your real estate agent will be able to help guide you in the right direction.

Automatic cancellation – Lenders are required by law to remove PMI automatically from a borrower’s mortgage if all pertinent criteria are met. When the loan balance drops to 78%, lenders must eliminate PMI as per the Homeowners Protection Act, as long as you stay up-to-date on all your scheduled payments.

How to Eliminate FHA MIP

FHA loans are not eligible for mortgage insurance cancellation. However, there are still ways that you may be able to get out of it, and refinancing is usually the way to go about it.

If your finances are in order and your credit score is high enough, you may be able to refinance out of your original FHA home loan into a conventional mortgage without PMI. Since FHA loans don’t have prepayment penalties for paying these types of loans off early, you won’t have to worry about having to pay an added fee to get out of it. As such, you can refinance whenever you like, as long as you have an LTV of at least 80%.

If you took out your FHA mortgage before June 2013, you can cancel your MIP after five years if you have a 30-year mortgage without the need to refinance. With a 15-year loan, there’s no minimum. In this case, you need to have at least 22% equity in your home and have been on time with all of your payments.

The Bottom Line

Paying mortgage insurance on top of your mortgage may seem like wasted money, but you may be able to cancel it if you’ve got all your ducks in a row. Be sure to speak with an experienced mortgage specialist to help you assess whether you’re ready to finally ditch that pesky payment once and for all.