How to Decide Between a Conventional or FHA Home Loan

When it comes time to apply for a mortgage, which avenue should you take? There are several types of home loan products available, but the one you decide on should closely match your needs and financial position.

More specifically, should you apply for a conventional mortgage, or does an FHA home loan work best for you? How can you decide between the two?

What is a Conventional Loan?

Before you decide which product is best for you, it’s important to understand what each one is and what they can provide you with.

A conventional loan is a mortgage that requires a 20% down payment. They also tend to be the more challenging types of mortgages to get approved for, as the loan criteria that borrowers must have to get approved are pretty stringent. To get approved for a conventional loan, you’ll typically require the following:

- A good credit score (at least 650)

- A low debt-to-income ratio (DTI), which should be no more than 43%

- A down payment of at least 20%, which will allow you to avoid paying private mortgage insurance (PMI)

These loans are not backed by the government like FHA loans are.

It should be noted that although conventional mortgages require a 20% down payment, there are high-ratio conventional mortgages available that allow borrowers to put down as little as 5%. They’re named so because the loan-to-value ratio (LTV) is more than 80%.

In this case, the lender is more at risk in case the borrower defaults on the loan because the loan amount is much higher. In this case, PMI would be charged as a means to protect the lender should the borrower default on the mortgage payments.

What is an FHA Loan?

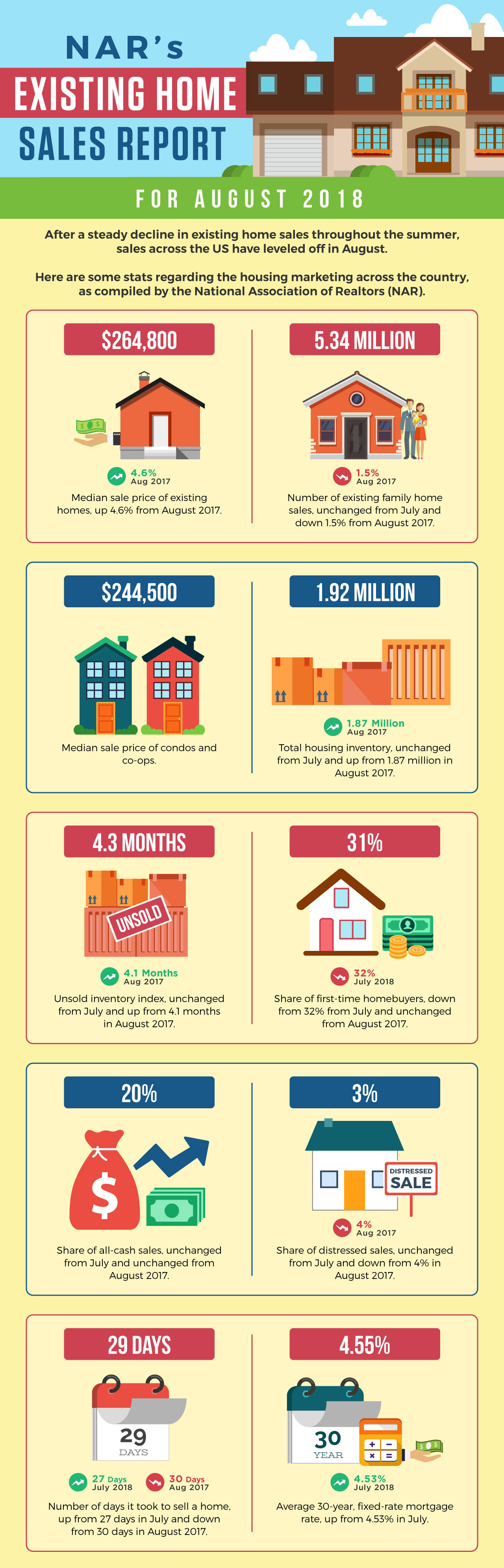

FHA loans are those that are backed by the Federal Housing Administration (FHA) and has less stringent loan criteria. For this reason, FHA loans tend to be pretty popular among first-time homebuyers and borrowers with a less-than-perfect credit score. Borrowers with a score of at least 580 should be able to qualify for an FHA loan.

These types of mortgages are also attractive for those who can’t come up with a sizeable down payment, as they allow a minimum down payment amount of 3.5% of the purchase price of a home. Like high-ratio conventional loans, FHA loans require mortgage insurance to be paid given the low down payment and high loan amounts.

Which Loan Type is Right For You?

In order to help you decide between these two loan types, let’s dive deeper and get more detailed into the factors listed above.

Credit score.

In order to qualify for a conventional loan, you’ll need a good credit score. More specifically, a score of at least 650 would be required for approval. A higher credit score will not only increase your chances of approval, but it will also help you obtain a lower interest rate, which can make your overall home loan more affordable.

If your credit is suffering somewhat, a conventional loan might not work in your favor. In this case, an FHA loan might work better for you. Generally speaking, a score of 580 should be enough to get you approved, as long as all other factors align with home loan approval. That said, every lender will have their own specific criteria when it comes to credit scores required.

Down payment and mortgage insurance.

As mentioned earlier, an FHA loan requires a minimum down payment amount of 3.5% of the purchase price of the home. If you’re having a tough time coming up with a sizeable down payment for a mortgage, an FHA loan might be easier for you.

It should be noted, however, that Mortgage Insurance (MIP) will be required on down payments that are less than 10% with FHA loans. Even though you are responsible for making these premium payments, it’s the lender that’s protected, not you. If you ever default on your loan payments, the insurance policy will kick in to reimburse the lender.

Conventional loans require a 20% down payment, which can be a hefty amount with a more expensive home purchase. But with a 20% down payment, you can avoid having to pay Private Mortgage Insurance (PMI), which works similar to MIP. However, high-ratio conventional loans allow as little as 5% down, though PMI would have to be paid in this case.

That said, you can eventually eliminate PMI payments once you’ve paid down the loan balance to 80% of your home’s original appraised value. With FHA loans, mortgage insurance can’t be eliminated.

Debt-to-income ratio (DTI).

No matter what type of loan you apply for, your lender will look at your income and debt load. More specifically, they’ll assess how much of your monthly income is dedicated to paying down your monthly debt obligations. A debt-to-income ratio is calculated by dividing your debt by your income. For example, if your monthly debt is $3,000 per month and your monthly income is $7,000, your DTI would be 43%.

Conventional lenders like to see DTIs of no more than 43% before agreeing to approve a mortgage application. However, DTIs that are lower than 36% are preferred.

With FHA loans, you may be able to get approved with a DTI as high as 50% as long as all other factors check out.

Refinancing process.

Refinancing basically involves replacing your existing loan with a new one, in which the new loan pays off the current debt. If you want to take advantage of refinancing at some point throughout your mortgage, you might find that the process is much more streamlined with FHA loans compared to conventional mortgages.

With a conventional mortgage, you’ll likely have to go through the entire loan application process over again and pay all the associated closing costs, which can wind up taking up a lot of time and money. With FHA loans, you can refinance your FHA loan through the Streamline Refinance process without having to fill out all the same amount of paperwork and paying all the fees that would be associated with refinancing a conventional loan.

The Bottom Line

Depending on your credit score, debt load, down payment amount, and income, one specific loan type might be better than the other for you. It’s important to assess your current financial situation and your eligibility criteria, which will then help guide to which loan product you might be better suited for. Speak with a licensed mortgage specialist to help you make the right decision for you.